Sponsored by Consolidated.Credit:

It’s a big problem faced by many credit card users at the end of every month — when the bills arrive and they have to pay the huge amount due within a specific amount of time.

Management of your finances is a tough task and many fail to do it well, which causes huge debts and ultimately, can lead to bankruptcy.

This article provides information to help you solve your problems regarding management of your credit cards and meeting the bills at the end of the month. Before we begin with the consolidation of credit card debt part, I want to give you some important facts about credit cards.

Facts

- Credit card bills state the minimum amount that you need to pay at the end of every month to keep the credit rolling and continue your services. However, if the entire amount on the card is not paid, then high interest rates are levied on the whole balance.

- Much of the income of the banks issuing credit cards comes from inter-bank transactions because of the involvement of a third merchant and the related service charges.

- Interest charged as penalties for not paying your entire balance is as high as 20-30% and depends on the types of credit cards you have.

What is Debt Consolidation for Credit Cards?

Sometimes your credit card debt is so huge that taking a separate loan at a lower interest rate becomes essential for you to repay the outstanding balance and avoid bankruptcy.

Why is Consolidation of Debts Necessary?

Many people carry more than one credit card, which implies there is more than one credit card bill to be paid each month — some with higher amounts, too. Sometimes you realize you’re paying more debts than your income. Different credit cards levy variable interest rates that many times people aren’t aware of. Hence, consolidation of all the debts lessens the burden of pending payments. To ensure faster payments, it’s wise to merge all balances into one account.

How can You Consolidate Your Credit Card Debts?

Before consolidating your credit card, get some advice from an experienced financial planner about your debt management strategy to ensure it works well for your situation. You should know all your best options, different choices, and your own promises for abiding by a new plan, and then finally, come to a decision. Here are some strategies that can be followed for consolidating your debts.

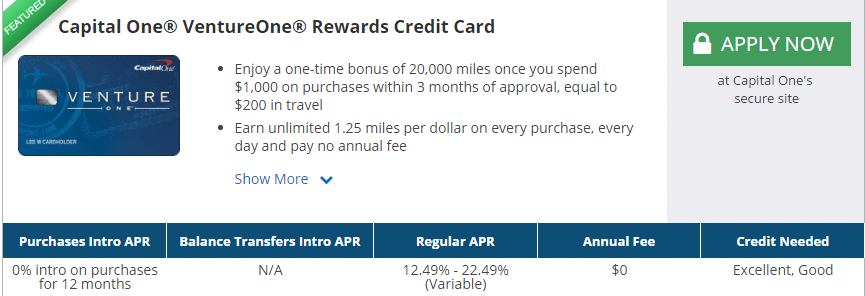

1. Choice of a Credit Card

A credit card with an introductory 0% APR (annual percentage rate) is the best for consolidating your future debts. These types of cards allow you to pay your debts over a year without charging interest rates or charging a very nominal amount of interest.

The introductory period may be as long as 21 months. Debts paid in the promotional period can allow you to avoid paying huge amounts of interest. The only drawback is you need a higher credit score to qualify for such cards.

2. Taking Personal Loans

Sometimes taking personal loans in small amounts from banks can help in paying your debts. Personal bank loans charge Simple Interest, which lowers the interest and simultaneously helps to pay your credit card debts. This helps in saving your money from the recurring interest charges of a credit card and can give you a lower interest rate.

3. Paying in Installments

Some credit card merchants allow you to pay your debts in small amounts every month (EMI). This saves you from the burden of a huge debt and allows you to pay in small monthly installments.

4. Manage Your Expenditures

If you have a large loan to be repaid, it is advisable to reduce your current expenditures. You should save money to first clear all existing debts so that the burden is gone or else it might cause severe debts and keep you from following your debt management strategy.

5. Consult a Credit Counseling Agency

These agencies pay your debts to each of your credit card lenders on a monthly fee basis to the company. Sometimes the lenders lower interest rates when you’re involved with one of these agencies. They put you into a Debt Management Plan, which might last for a span of three to five years.

Check Your Credit Scores

A credit card debt consolidation strategy might affect your credit score.

Credit scores are numerical scores that help in analyzing your creditworthiness. These are based on credit reports made by the issuers on the lines of credit for your purchases. These scores help lenders decide whether a consumer qualifies for a loan, interest rates that can be levied, and what credit limits can be set. These scores help them determine which borrowers can bring the best revenue for the bank.

Therefore, if you are on a debt management plan and you are trying to consolidate your credit cards, you might end lowering your credit score. Some creditors might suspend your account, which might cause a negative impact on your line of credit.

However, once you complete your plan, some creditors might restore your account seeing your new debt-free status and your on-time payment history thanks to to your debt management plan.

Follow Your Debt Management Strategy Strictly

Abiding by your debt management plan is critical to keep your credit scores up. Your history of credit repayments helps to increase your credit score. Hence, doing the math before consolidating your account is essential. You need to keep in mind all the pros and cons related to your debt management strategy where the biggest disadvantage often lies in lowered credit scores.

Of course, it is always advisable to pay your bills on time and avoid huge transactions, which you cannot promise to repay. This would save you from loads of trouble.