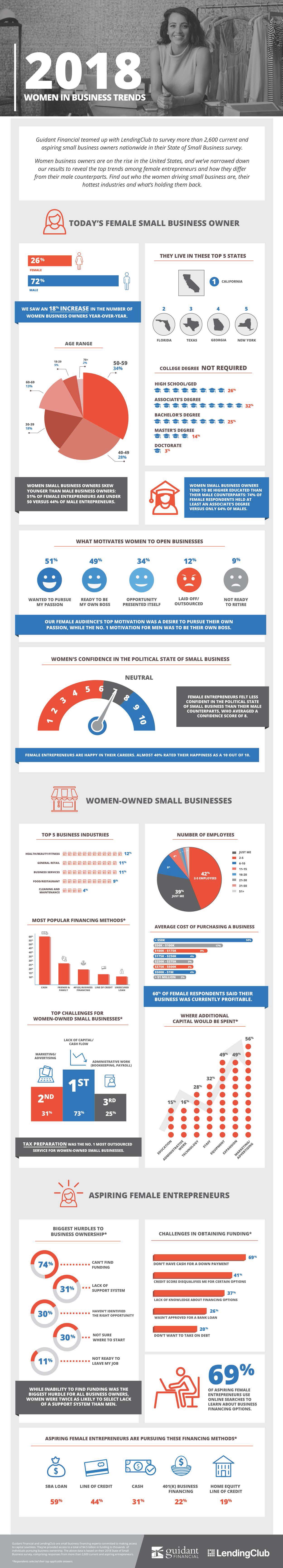

The number of women business owners increased by 18% in 2017. Today, 26% of business owners are women, and they tend to be younger than male business owners with 51% of women business owners under the age of 50 compared to 44% of male business owners. This data comes from a survey conducted by Guidant Financial of 2,600 small business owners and hopeful business owners. Among the respondents, women accounted for 24% of aspiring business owners.

The study also revealed that women small business owners tend to have more education than male business owners with 74% of women holding an associate’s degree at a minimum compared to 64% of men. The most popular states for women to start businesses according to this survey are California, Florida, Texas, Georgia, and New York in that order.

When it comes to what motivates women and men to start their own businesses, pursuing a passion is the top motivator for 51% of women, but the top motivator for men is to be their own boss (49%). Women ranked being their own boss second (49%) followed by an opportunity presented itself (34%), they were laid off or outsourced (12%), and they were not ready to retire (9%).

Overall, 40% of women who responded to the Guidant Financial survey indicated that they were happy in their careers by rating their happiness level a 10 out of 10. Additional highlights from the study include:

- The top five industries that women start businesses in are health/beauty/fitness, general retail, business services, food/restaurant, and cleaning and maintenance.

- Most women business owners own businesses with 2-5 employees (42%) followed by just one employee – themselves (39%).

- More than half of female entrepreneurs (58%) who purchased businesses did so for less than $50,000.

- Among women who financed their businesses, nearly 60% did so with cash. Less than 15% were able to get a line of credit or unsecured loan.

- The top challenge for women business owners is a lack of capital or cash flow (73%).

- The most commonly outsourced task among women business owners is tax preparation.

- 60% of women business owners say their businesses are profitable.

- If they had additional capital, most female business owners (56%) would invest in marketing and advertising.

Among women who want to be business owners in the future, the biggest obstacle they report facing is that they cannot get funding (74%). More than two out of three aspiring female entrepreneurs (69%) use the internet to learn about financing options, and the same percentage of women don’t have the cash for a downpayment to start their businesses. Most of them (59%) are pursuing an SBA loan to fund their businesses, but according to Guidant Financial, fewer female entrepreneurs secure SBA business loans than male entrepreneurs.

You can see all of this data and more in the infographic from Guidant Financial below. What do you think? Do any of these statistics surprise you? Share your thoughts in the comments below.