Sponsored by PDFelement:

Wondering if you’re eligible to file for a tax refund with the IRS? If you have no clue where to start, then you’re not alone. Many people are confused by the U.S. tax code, but luckily, PDFelement created an infographic that guides you through the steps to apply for a tax refund with the IRS. This infographic also details some facts you might not know about U.S. taxes including things like how the tax system works, tax revenue streams, and how people spend their tax refunds.

What You Didn’t Know About U.S. Tax

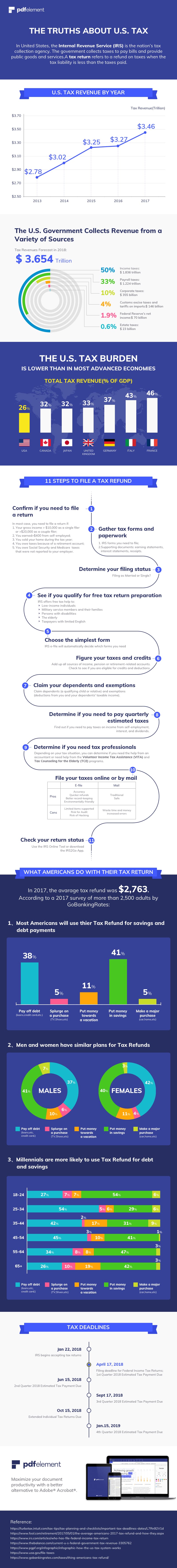

For starters, did you know that U.S. tax revenue has been growing steadily over the past five years? According to the tax revenue stats detailed in the infographic, the revenue generated from taxes was $3.64 trillion in 2017 while it was $2.78 trillion back in 2013. That’s close to a $1 trillion increase in just four years, and it’s expected to grow even more in 2018.

The projections are around $3.654 trillion when the numbers come in this year. Interestingly though, the numbers detailing the tax burden show that despite the escalating figures, the U.S. tax burden is significantly less than the numbers in other developed nations like Canada, Japan, the United Kingdom, Germany, Italy, and France. France leads the pack with a tax burden of 46% of GDP, followed by Italy at 43%, Germany at 37%, the United Kingdom at 33%, Japan and Canada at 32%. The U.S. is at 26%.

From the infographic, it can also be seen that income taxes account for half of the revenue collected, followed by payroll taxes, which account for 33% of the revenue collected by the government. Corporate taxes, on the other hand, account for 10% of the revenue with custom excises, Federal Reserve, and estate taxes accounting for the remaining percentage of the revenue collected.

Use Your Tax Refund To Service Debts and Create Some Savings

Of course, you can do anything with your tax refund, but research from the past shows that most Americans use their tax refunds to clear debts and fill up their savings accounts. 41% service their debts while 38% save the cash with the remainder using it to buy homes, go shopping, take vacations, and make major purchases. The trends are more or less the same for men and women in terms of what they do with their tax refunds.

Millennials are also more likely to put their tax refunds toward savings and debts with those between the ages of 25 and 34 most likely to use the cash to offset debts. Interestingly, those age 65 and above are more likely to splurge on a purchase compared to any other age cohort, including millennials!

You can get more details about U.S. taxes in the infographic above. Just remember, the deadline to file your tax return is fast approaching. It’s April 17, 2018!